Hedging is a process to protect the position we take in a currency pair (referred to as an asset) from the risk of loss caused by unexpected events. It is a method that involves opening two opposite positions, namely, Buy and Sell, with the same lot on a currency pair/asset.

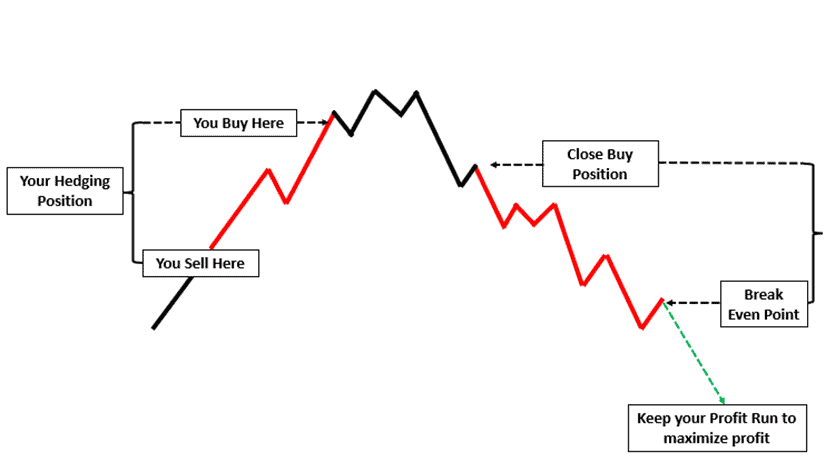

For example, you have a bias that GBP/USD will weaken, then open a Sell GBP/USD position of 0.25 lots at 1.6000, and now the price has increased by 25 pips and is at 1.6025. So, to lock in your losses, you open a Buy GBP/USD position of 0.25 lots at 1.6025.

If it turns out that your previous analysis is correct and GBP/USD weakens again, you can close the Buy GBP/USD position of 0.25 lots at 1.6025 at any loss and leave the Sell GBP/USD position of 0.25 lots at 1.6000 open to get a profit in total.

The downside is, sometimes a trader will find it difficult to determine which position to close, especially if the market conditions were uncertain when they were hedging.

However, if you have mastered this method, it can be an extraordinary strategy to get a good profit.

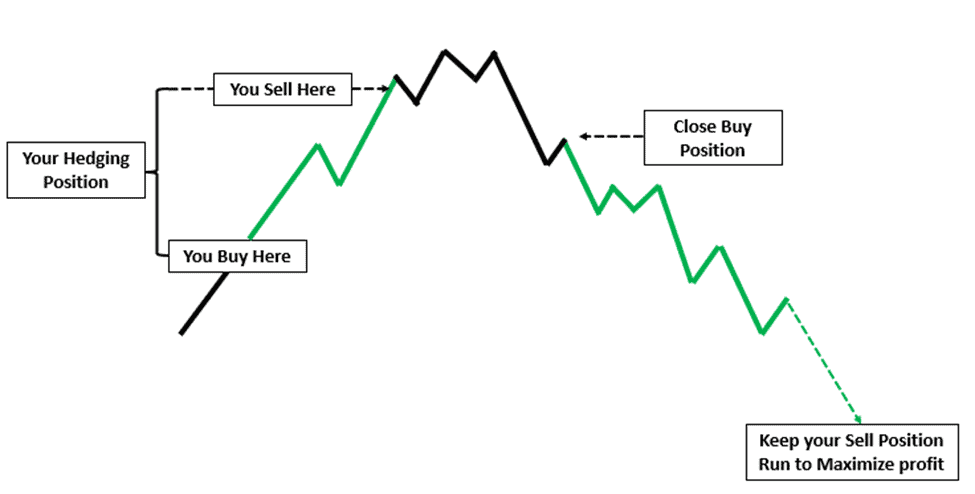

Illustration: A trader has a bullish bias towards an asset and then enter a BUY position. After some time, the trader analyzes that there is a possibility of a correction, and then decides to keep his BUY position and open a SELL order. After some time, the price seems to be going down, so the Trader takes profit from the BUY order they opened earlier so that they get the maximum profit from the Sell position.

By doing the method mentioned above, which is using hedging to take a minor correction to the increase in an asset, a trader has locked the profit they got in the first place. To wait to the market to provide more information about where it will go next. If the analysis is gone wrong, the trader has various options to decide.

Risk of Using the Hedging Strategy

The hedging strategy itself does not mean that we eliminate the risk factor from our trade. Don’t forget that a hedging strategy has a cost associated with it. An example is paying a larger spread/commission than usual. Consider this and more before using the hedging strategy.

So, before you decide to use hedging, you should ask yourself if the potential benefits justify the costs you pay. Remember, the purpose of hedging is not to make money from it but as an attempt by traders to protect against losses.

The costs of hedging, be it trading fees (spreads/commissions) or the potential for losing more profits from using the opposite position, are unavoidable.

It is better if the hedging strategy is carried out by individuals who already understand the risk of hedging and can read the market structure well.

If someone uses a hedging strategy without any basic understanding, there’s a possibility that the trader might be trapped in endless hedging. This means hedging will continue to open and close and get wider and wider, which could result in the reduction of equity and balance.

Since hedging is quite difficult, try to make friends with time and statistics. Practice strict risk management so that your account can grow optimally in the long term.