On Tuesday, the stock market experienced a significant decline, with the Dow Jones Industrial Average falling by 388.00 points, marking its worst day since March. The S&P 500 and Nasdaq Composite also saw notable drops, and Amazon’s shares fell 4% due to an antitrust lawsuit. This decline is part of a broader trend in September, with the Nasdaq down nearly 7%, influenced by factors such as the Federal Reserve’s indication of fewer rate cuts and ongoing uncertainty. In the currency market, the US dollar surged, reaching a ten-month high, driven by a retreat in other currencies and hawkish comments from Fed officials. The article also highlights the impact on currencies like the British pound and the Japanese yen.

The stock market experienced a significant decline as the Dow Jones Industrial Average fell by 388.00 points, or 1.14%, to close at 33,618.88. This marked the worst day for the Dow since March, and the index closed below its 200-day moving average for the first time since May. The S&P 500 also saw a 1.47% decrease, closing below 4,300 for the first time since June 9, while the Nasdaq Composite dropped by 1.57% to 13,063.61. Amazon’s shares took a hit, falling 4%, following an antitrust lawsuit filed by the Federal Trade Commission, alleging that the online retailer keeps prices artificially high and harms its competitors. Additionally, disappointing data emerged, as August new home sales missed expectations and the Conference Board’s consumer confidence index fell, contributing to the overall bearish sentiment in the market.

The stock market’s losses for the month are accumulating, with the Nasdaq Composite down nearly 7% in September, and the S&P 500 and Dow both experiencing declines of more than 5% and 3%, respectively. This downward trend has been influenced by factors such as the Federal Reserve’s indication of fewer rate cuts in the coming year, leading to a rise in bond yields not seen since 2007. Investors remain cautious, given the uncertainty about the economy, the Fed’s actions, and the value of the dollar. Meanwhile, lawmakers in Washington are negotiating to prevent a government shutdown that could occur as early as October 1 if a spending bill agreement is not reached. Despite these challenges, October, historically known as a “jinx month” for market crashes, is also considered a potential “bear killer,” according to the “Stock Trader’s Almanac,” providing opportunities for investors in the midst of seasonal market volatility.

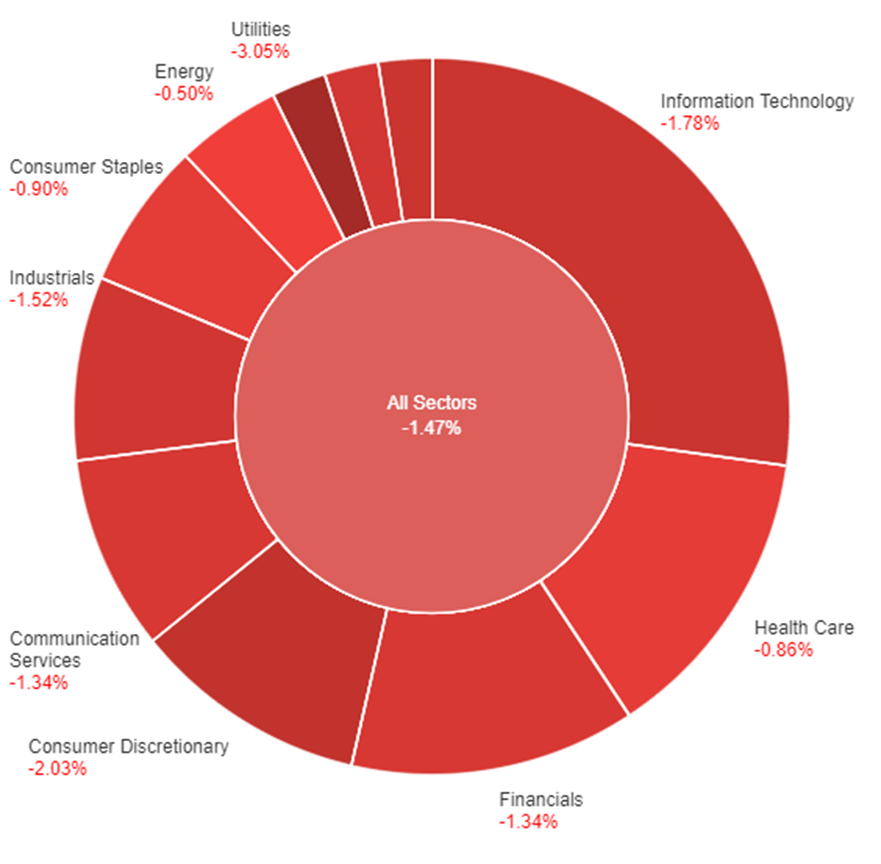

Data by Bloomberg

On Tuesday, across all sectors, the market experienced a decline of 1.47%. Notably, Utilities were hit the hardest with a significant decrease of 3.05%, while Consumer Discretionary also saw a substantial drop of 2.03%. The Information Technology and Real Estate sectors both had losses of 1.78%, and most other sectors saw negative trends ranging from -0.50% in Energy to -1.52% in Industrials. Financials and Communication Services also suffered losses of -1.34%, while Health Care and Consumer Staples had slightly smaller declines of -0.86% and -0.90% respectively. Materials fell by 1.45% on this day.

In recent currency market developments, the US dollar experienced a notable surge, with the dollar index rising by 0.24%, marking its highest point in nearly ten months. This uptrend was driven by a retreat in currencies like sterling, the Australian dollar, and the euro, while USD/JPY held steady, partly due to the threat of intervention by the Ministry of Finance and a preference for the safe-haven yen amidst risk-off sentiments. Notably, there was an initial pullback in Treasury yields, but this decline was reversed, leading to a fresh six-month low for the EUR/USD pair during the New York session. Despite weaker-than-expected US consumer sentiment and new home sales, the rebound in US yields persisted, largely driven by hawkish comments from officials like Minneapolis Federal Reserve Bank President Neel Kashkari and Chicago Fed President Austan Goolsbee. Additionally, concerns about Italy’s fiscal plans led to an increase in 10-year BTP-bund yield spreads, further impacting the euro’s performance.

Furthermore, the British pound weakened by 0.43% in response to the recent hawkish stance of the Federal Reserve, combined with indications from the Bank of England that rate hikes might be on hold, despite inflation levels remaining significantly above the 2% target. In terms of technical levels, Cable (GBP/USD) approached critical Fibonacci support levels. On the other hand, USD/JPY witnessed fluctuations and achieved new 2023 highs, only to be influenced by daily Japanese government warnings about potential FX intervention to counter excessive yen weakness. The 150 level is seen as a potential line in the sand for the Ministry of Finance, although traders appear inclined to continue buying dips unless disappointing US data leads to a halt in the rise of Treasury yields over Japanese Government Bond (JGB) yields. Amidst these dynamics, the US dollar exhibited strength against most high-beta currencies, and the USD/CNY pair experienced a marginal decline. Looking ahead, the US data calendar remains relatively light until Friday when personal income, spending, and core PCE data are expected, provided there is no government shutdown, with other releases including the Chicago PMI and Michigan sentiment for September, as well as eurozone CPI data.

EUR/USD Decline Continues Amid Strengthening US Dollar and Risk Aversion

The EUR/USD pair faced continued declines and struggled to maintain levels above 1.0600, primarily driven by the robust performance of the US Dollar in various markets. The US Dollar index achieved its highest daily close in months, surpassing 106.10, supported by elevated US yields. Despite weaker-than-expected US economic data, the dollar remained resilient. Wall Street experienced a decline in equity prices, further bolstering the Dollar’s surge. Upcoming reports on German and Spanish inflation data, as well as the Core Personal Consumption Expenditure Index from the US, are eagerly anticipated by market participants as potential market movers.

According to technical analysis, the EUR/USD moved lower on Tuesday and created downward pressure on the lower band of the Bollinger Bands. This movement suggests the possibility of further losses in EUR/USD. The Relative Strength Index (RSI) is currently at 32, indicating a bearish bias for the EUR/USD.

Resistance: 1.0588, 1.0620

Support: 1.0541, 1.0517

XAU/USD Dive as US Dollar Soars Amidst Growing Economic Concerns

In a sharp decline, spot gold (XAU/USD) fell to $1,900.83, marking its lowest point in nearly two weeks. This slide was driven by a surge in the US Dollar, triggered by mounting apprehension in the financial markets due to central banks’ commitment to keeping rates higher for longer and disappointing economic data from the United States. The US CB Consumer Confidence Index extended its decline, indicating potential recession signs, while New Home Sales saw a substantial drop. Federal Reserve Bank President Neel Kashkari’s remarks added to the uncertainty, with investors worried about prolonged monetary tightening. This confluence of factors kept gold at the lower end of its monthly range, while Wall Street experienced a sell-off and 10-year Treasury note yields reached levels not seen since 2007.

According to technical analysis, XAU/USD moved lower on Tuesday, creating downward pressure on the lower band of the Bollinger Bands. Currently, the price is hovering just above the lower band, suggesting a potential further decline for XAU/USD. The Relative Strength Index (RSI) is currently at 27, signifying a bearish bias for the XAU/USD pair.

Resistance: $1,908, $1,915

Support: $1,893, $1,885

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | CPI y/y | 09:30 | 5.2% (Actual) |