On Thursday, the stock market faced a decline driven by concerns over rising Treasury yields and persistent US inflation, marking the end of a four-day winning streak for major indexes. The Dow Jones Industrial Average dropped 0.51%, while the S&P 500 and Nasdaq Composite fell by 0.62% and 0.63%, respectively. Meanwhile, the US Dollar rallied by 0.80% as robust economic data and increased Treasury yields reinforced expectations of prolonged high interest rates. European currencies, such as the Euro and British Pound, experienced declines, while precious metals like Gold and Silver slipped due to rising Treasury yields. Geopolitical concerns, including the Israel-Hamas conflict, also contributed to market sentiment.

Stocks experienced a decline on Thursday due to concerns about rising Treasury yields and persistent U.S. inflation. The Dow Jones Industrial Average closed 0.51% lower, dropping 173.73 points to 33,631.14, while the S&P 500 fell by 0.62%, finishing at 4,349.61, and the Nasdaq Composite lost 0.63%, closing at 13,574.22. This decline marked the end of a four-day winning streak for the major indexes. Treasury yields surged with the 10-year rate increasing by nearly 11 basis points to 4.70%, while the 2-year Treasury yield reached 5.06% after rising more than 6 basis points. Many investors believe that higher yields are becoming a permanent feature, which influenced the equity market’s downturn. The consumer price index released on Thursday revealed a 0.4% increase on the month and a 3.7% increase from a year ago, exceeding Dow Jones estimates of 0.3% and 3.6%, respectively.

In corporate news, Walgreens saw its shares trade 7% higher after reporting narrower losses and progress in cost-cutting plans, although it offered soft profit guidance and missed earnings expectations. Additionally, several major companies, including JPMorgan, BlackRock, and UnitedHealth Group, are scheduled to report earnings on Friday. Geopolitical concerns also played a role in market sentiment, as the ongoing Israel-Hamas conflict raised questions about a potential oil supply crunch and a subsequent increase in fuel prices should the instability spread to neighboring oil-producing regions.

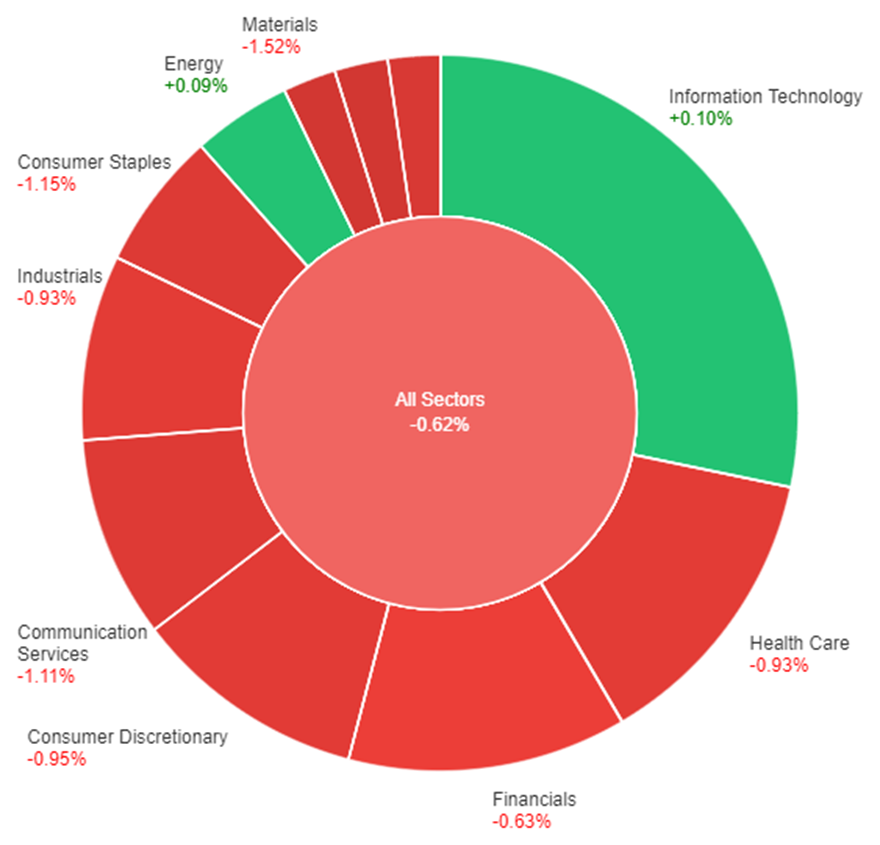

Data by Bloomberg

On Thursday, across all sectors, the overall market saw a decline of 0.62%. The Information Technology sector performed the best with a modest gain of 0.10%, while Energy followed closely with an increase of 0.09%. On the other hand, the Utilities sector experienced the most significant drop, with a decline of 1.50%. Additionally, Real Estate, Consumer Staples, and Materials sectors also saw notable decreases, declining by 1.31%, 1.15%, and 1.52%, respectively. The Financials, Health Care, Industrials, Consumer Discretionary, and Communication Services sectors all recorded losses ranging from 0.63% to 1.11%.

The US Dollar exhibited a significant rally, recovering from previous losses but still below recent cycle peaks. The US Dollar index surged by 0.80% to reach 106.55, primarily propelled by robust US economic data and increased Treasury yields. In September, the US annual Consumer Price Index (CPI) exceeded expectations, registering at 3.7%, surpassing the market consensus of 3.6%. The Producer Price Index (PPI) also outperformed expectations, and Initial Jobless Claims remained slightly below the consensus, at 209,000. This series of strong US economic data and the persistence of inflation above target levels reinforced expectations of prolonged high interest rates. Analysts noted that the Federal Reserve is likely to remain patient as it assesses the overall data, with the focus on the upcoming November FOMC meeting. Meanwhile, US Treasury yields experienced an increase, with the 10-year yield rising from 4.57% to 4.73%, and the 2-year yield from 4.98% to 5.07%.

In the currency markets, the Euro (EUR/USD) saw a significant decline to 1.0525 from around 1.0630 due to the strengthening US Dollar, driven by the robust economic data. Europe is awaiting the release of Industrial Production data for August and an appearance by European Central Bank (ECB) President Lagarde at the annual International Monetary Fund and World Bank meeting. The British Pound (GBP/USD) ended its six-day positive streak, recording a 140-pip drop below 1.2200 amid negative risk sentiment. The New Zealand Dollar (NZD/USD) declined for the second consecutive day, falling below 0.6000 and the 20-day Simple Moving Average (SMA) to reach 0.5925. New Zealand is poised to release Electronic Card Retail Sales data and the Business NZ PMI for September. The Australian Dollar (AUD/USD) posted one of its lowest daily closes for the year, hovering slightly above 0.6300, with a downward bias and attention on the October lows at 0.6285. Meanwhile, the Canadian Dollar (USD/CAD) strengthened, approaching 1.3700 on the back of US Dollar strength, with a potential target of 1.3800 if it closes above 1.3750. Precious metals like Gold and Silver faced declines due to the rise in Treasury yields, with Gold slipping below $1,870 and Silver dropping beneath $22.00. Upcoming data releases from China and Europe, as well as the University of Michigan Consumer Sentiment survey, hold the potential to impact these currency markets, especially those of the antipodean currencies.

EUR/USD Slides to 1.0520 as Stronger US Dollar, Rising Yields Pressure Pair

The EUR/USD pair dipped from weekly highs above 1.0630 to 1.0520, driven by a stronger US Dollar bolstered by higher Treasury yields and encouraging US economic data. The European Central Bank’s recent meeting minutes revealed support for a potential interest rate hike, though this had a limited impact on the Euro. Meanwhile, the US Dollar gained further momentum following a 0.4% rise in the Consumer Price Index (CPI) for September, adding to expectations of prolonged higher interest rates. With the 10-year yield surging to 4.72%, the Greenback’s correction ended, leaving it poised to challenge cycle highs.

Based on technical analysis, the EUR/USD fell on Thursday, pushing towards the lower band of the Bollinger Bands. Currently, the EUR/USD is trading around the lower band, while the bands are trending upwards, suggesting the potential for consolidating move to retest the middle Bollinger Band. The Relative Strength Index (RSI) stands at 42, indicating that the EUR/USD is back to netural bias.

Resistance: 1.0582, 1.0640

Support: 1.0520, 1.0460

XAU/USD Dip as Hawkish Fed Sentiment Surges on Strong US CPI Data

Investors are reevaluating their expectations for the US Federal Reserve as robust Consumer Price Index (CPI) data, revealing a 0.4% increase last month and an annual inflation rate of 3.7% in September, further strengthens the narrative of “higher rates for longer.” This has boosted the US Dollar and Treasury bond yields, causing Gold prices to retreat from their recent two-week high above $1,880 and dip below $1,870. The surge in hawkish Fed sentiments is fueling uncertainty, with markets now placing a 38% probability of a December rate hike, compared to the previous 28%. In addition, softer Chinese CPI and Producer Price Index data are contributing to risk aversion. As we await US Consumer Sentiment and Inflation Expectations data, along with speeches from Fed policymakers, the future of the US Dollar remains uncertain.

Based on technical analysis, XAU/USD is moving slightly lower on Thursday and able to reach the middle band of the Bollinger Bands. Currently, the price of gold is trading slightly above the middle band with the potential of moving back higher. The Relative Strength Index (RSI) currently registers at 62, indicating a bullish bias for the XAU/USD pair.

Resistance: $1,887, $1,900

Support: $1,857, $1,845

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Prelim UoM Consumer Sentiment | 22:00 | 67.2 |